Executive summary

Banks have opened and shared their data with Third Party Providers since open banking came onto the scene in 2018 in the form of EU legislation PSD2 (Payment Services Directive).

In The Netherlands, open banking has faced direct competition with iDeal which is the native direct transfer payment method.

EU legislators are preparing new and updated regulations:

- PSD3 – better performing APIs and more standardisation

- FIDA – broadening data scope, from only payment and account info to other financial data (open finance)

- Instant Payments – transfer within 10 seconds at any time of the day, within the same country but also to another EU member state

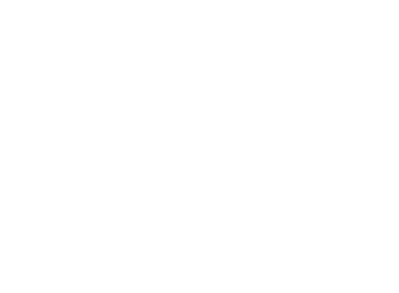

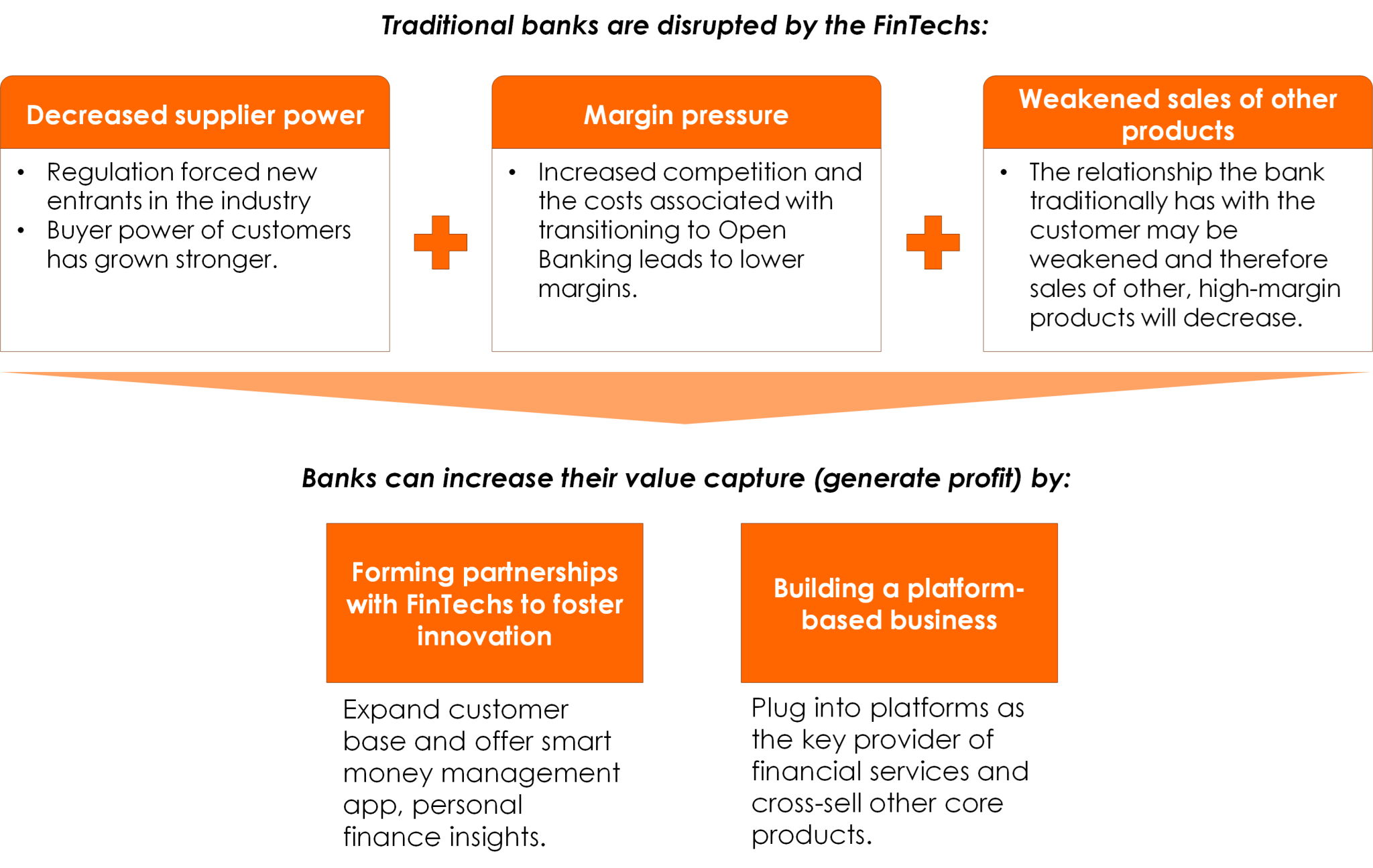

To capture more value and create new revenue streams, banks should get ahead and prepare for a platform-based business model:

- Act as the central actor of the platform

- Maintain intense partnerships with FinTech’s to enrich offers

- Unbundle vertically integrated value chains (from product-focused to customer-focused)

Business context

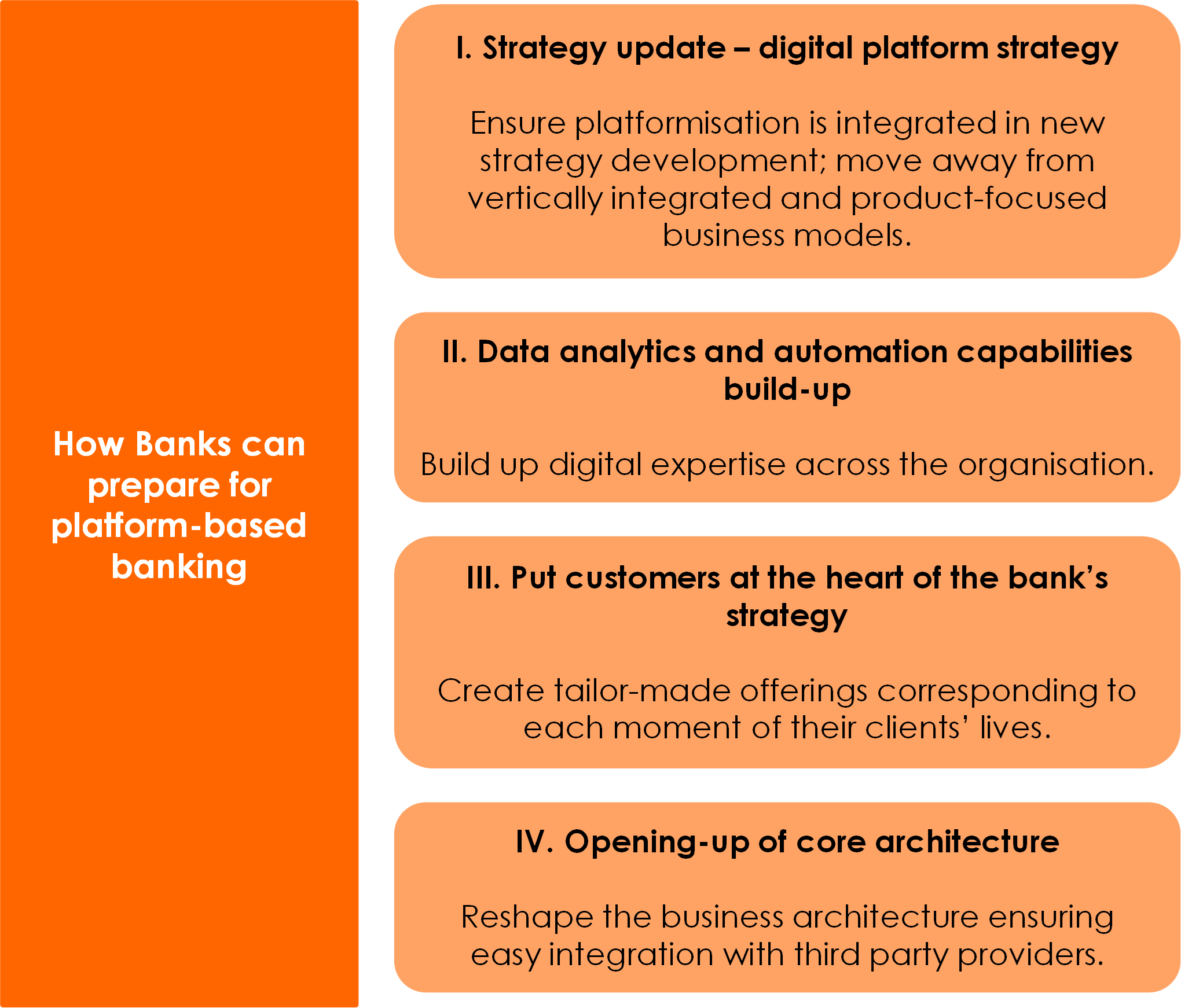

European industries adopted open banking due to customer difficulties in accessing and sharing financial data, which limited competition and innovation:

Anecdotally, the EU passed its PSD2 regulation (Payment Services Directive) in 2015 because of the effective lobbying of one specific German Fintech. Sofort (later acquired by Klarna) was using screen-scraping software to retrieve customer account data. Sofort enabled its customers to make online purchases by initiating transfers from their bank accounts and accused the banks of shutting out competition, when the latter introduced changes making it harder for third parties to log in on behalf of their customers.

Problem statement

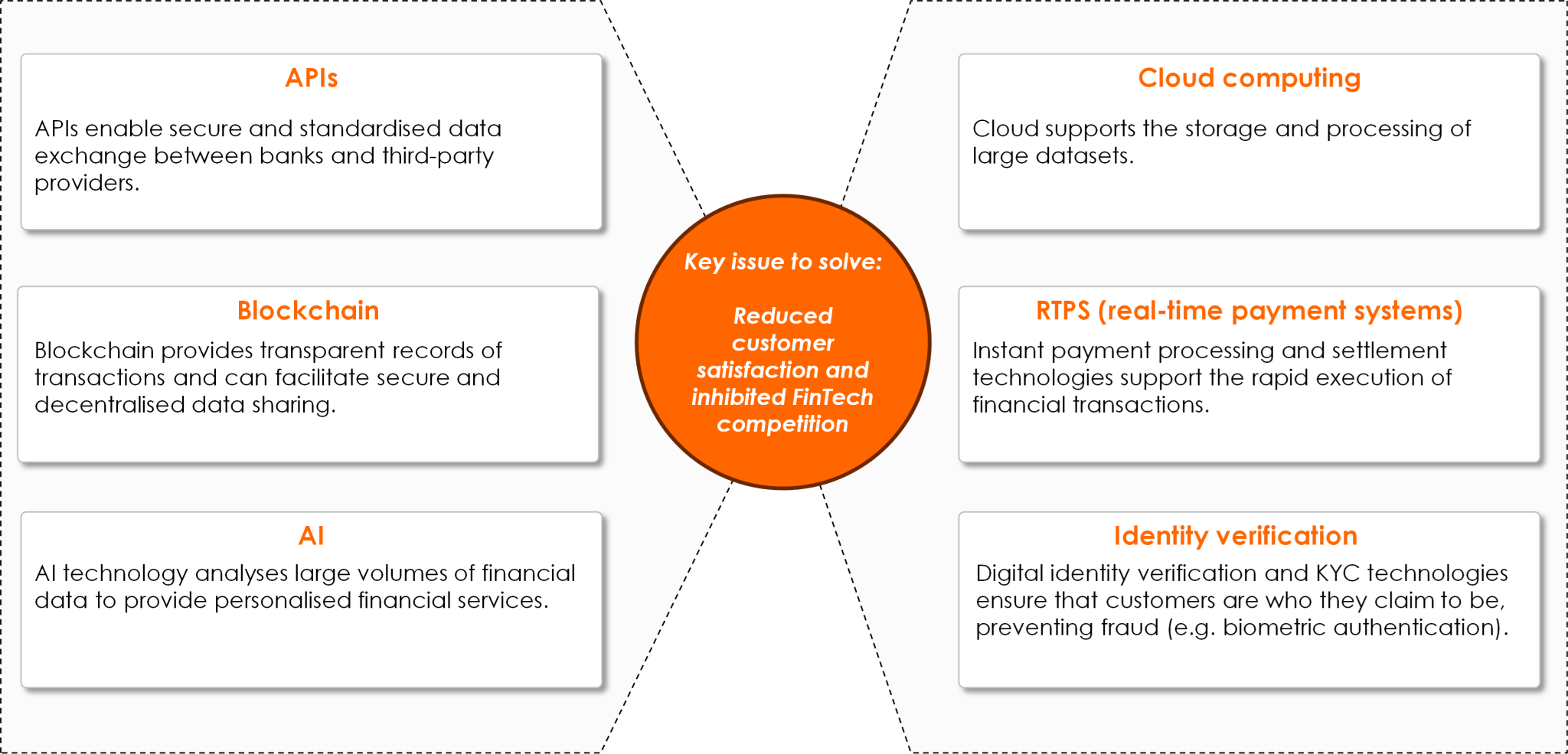

The key issue to address was the reduction in customer satisfaction and stifled competition by FinTechs:

- Information asymmetries gave incumbent banks an unfair advantage. Traditional banks hold a lot of information about customers. The latter lack the ability to easily access and share their financial data with third-party providers.

- FinTechs struggled to develop and offer services that meet customer needs. Fintech companies rely on access to comprehensive financial data to develop and offer services at more favorable terms than banks.

- Customers were losing out as a result. Customers had restricted ability to benefit from innovative financial services that require integrated data from multiple sources.

Technologies

Several key FinTech technologies facilitate secure and efficient data sharing between banks, third-party providers and customers.

Investments required:

- Modernise IT infrastructure and transition away from legacy systems

- External growth operations (acquisitions, equity investments, partnerships) to develop novel competitive advantages while protecting their core business. Partnerships are preferred as they are more flexible than equity investments and acquisitions and require a low level of integration.

- Obtaining regulatory clarity: EU regulators are already clarifying and harmonising legislation.

- Build public awareness: ongoing educational campaigns are necessary to ensure the Dutch public understands the value of open Finance and platform-based banking as the knowledge gap is still large (lessons to be drawn from insurance industry).