You may have come across one by chance, at a shop where you do your daily shopping for example; the so-called Paystation, a closed cash register system that automates manual cash handling at the checkout.

Cash remains an important means of payment and many consumers still pay for daily shopping with banknotes or coins. In addition, cash is crucial for the inclusion of socially vulnerable citizens, such as the elderly or lower-income groups.

Given market developments in retail (staff shortages, increased use of self-checkout, disappearance of service counters, ban on tobacco sales), there is a need for automating processes and increasing security. This can be done by automating cash processes. For example, when this solution was implemented at Albert Heijn, we saw an increase in the use of the self-checkout.

We ask Martijn Wiersma, Marketing & Sales Director at Brinks, about this successful cash solution innovation in the retail market.

Martijn, can you tell us a bit more about Brink’s?

Brinks, best known to the wider public as a cash and valuables transporter and recognisable by its blue cash vans, is constantly adapting on a changing market. For instance, we ensure that entrepreneurs can now accept all forms of payment.

For decades, for example, we have been working for supermarkets where we facilitate the cash money process. The recent addition of a closed cash system (the Paystation) at the self-checkout was the next step in optimising the customer experience in that industry.

In recent years, the trend has been to increasingly push back cash from the social landscape. Partly due to the Payment Transactions Covenant in which banks and point-of-sale establishments work together on a safer, more efficient and reliable payment system in the Netherlands, full use was made of debit card payments.

What impact did this have on Brinks?

Cash management was and certainly is our basic service. And indeed it was assumed that cash would eventually be finite. This downward trend over the past few years, with the market shrinking sharply, has caused consolidation. But in the Netherlands, among others, the Cash Money Covenant was adopted . Within the covenant, voluntary agreements have been made with the main stakeholders in the cash money chain. Groups of consumers are and will remain dependent on cash and therefore banks and retailers must continue to provide contant money payments. Brinks plays a crucial role in the overall chain.

What exactly was your concrete response to this declining trend of paying with cash?

We started investing heavily in innovation. With the main key question being: How can we better serve and relieve retailers in the field of cash processing/payments?

Based on analyses of market and customer needs, we revolutionised our entire business model and moved from cash transportation to offering sustainable, future-proof propositions, using smart technology. We now offer broader solutions across the customer cash chain.

How successful has this strategic shift been?

As it is with innovations, it takes time for new propositions to prove themselves and become the standard. We are no doubt all familiar with the so-called hockey stick effect where it takes a while for the market to show exponential growth. Fortunately, the willingness to invest has only grown in the declining cash market. Retailers are eager to move towards automation of their business processes, which is why we as an organisation have experienced the highest growth in the past period.

We also see the Netherlands, in particular, as a guiding country for these innovations. Dutch consumers are quick to accept new innovations. Furthermore, the Netherlands has a relatively high average labour wage, making it easy for retailers to make a business case.

Can you take us through the development of your innovations?

In the transition to a so-called tech-enabled company, we have always put a strong focus on customer needs. How do we maintain our high level of secure services? Our initial customer insights lead to the development of propositions with a focus on making our customers’ back offices more efficient and secure. This was followed by smart safe solutions, called smartsafes, which were placed at the checkout. And this was followed by the Paystation, our latest scalable innovation for the retail market. With the recent addition of a variant for the Self Check Out.

We at Brinks call this ‘Business Process Outsourcing’ where we facilitate the complete unburdening of the retailer for the handling of cash flows. This strategic recalibration marked the beginning of a new phase for Brinks: from back-office solutions to consumer-facing propositions. And this of course affects Brinks’ entire positioning. Where we are known for our blue vans, we are becoming a brand that consumers also increasingly relate to.

Back to the Paystation for a moment. Earlier you mentioned that the collaboration in the supermarket sector was so successful. Why is that?

As already mentioned, we have been working with major supermarket chains for a long time. Where we previously thought that self-checkout would be a threat because consumers there can only pay with debit card and that move has sharply reduced the number of line checkouts with cash, the redesign of renewed service squares on the shop floor presented a huge opportunity. Indeed, customers at self-scan plazas are also very keen to pay with cash. Conclusion: paying with cash should be as easy as paying with PIN.

Within a short period, a first version of the Paystation for the self-check-out square was then developed. Reactions from the pilots were very positive. Subsequently, the first prototypes were further developed into a robust and scalable solution that is currently being further rolled out.

Can you share the first successes with us?

What we have seen in the pilot phase is that there has been a significant increase in self-checkout usage by adding this cash solution. This means that customer satisfaction has gone up further as customers can choose how they pay and where they checkout.

In summary, we can say this cash management solution in this one-stop-shop model leads improvement in customer experience in the checkout process.

This unique end-to-end solution represents a breakthrough in shop concepts, where digital innovation and cash payments come together.

Is it true that your ambition does not stop at the border?

Indeed, we have also set our sights on the rest of Europe and are entering markets in Belgium, Greece and Romania, among others. Retailers want more harmonisation across their shops, nationally and internationally, and we are responding to that.

How do you keep your edge in this market?

We continue to innovate and develop towards the future. To this end, we have established Brinks Acceleration Centre, among others. We invite teams from organisations who use a workshop to map out their entire cash/payment process in order to arrive at the right improvements.

Using innovative, digital solutions in the form of technology, apps and platforms, we are developing scalable solutions for European markets that our clients can use in other countries, even if Brinks is not currently active there itself.

Furthermore, we also see a type of customer in the cash market that we serve through our recent solution BLUbeem . This is a total package for integrated cash, online and card payments for SMEs; a unique and competitive product as there is currently no party offering this integrated solution yet.

What would you like to pass on to other retailers?

‘Just do it’ in the sense of do it to experience the impact of offering convenient cash solutions on your organisation. You don’t know how your customer will react. Our solutions are easily applicable on the shop floor and in this fast-changing environment in terms of Payments, you need to make sure you keep customers happy by not steering them towards one type of payment method, namely pin. Let everyone choose how they want to pay. Our cash solution is very easy to test. And Brinks is happy to support this.

To make the first tests with the Paystation possible, Brinks sought cooperation with Connective Payments, specialists who can support cash management issues. Frits Steenmeijer, consultant at Connective Payments and as project manager responsible, among other things, for the realisation of the pilot says the following:

“The pilot solution was created in a very short time. Based on pilot experiences, a large number of hardware, software and process improvements were implemented. All these improvements led to more efficient and cost-effective management and servicing of Paystations”.

The aim of this project was also to ‘develop’ the pilot solution so that it could become a scalable solution.

Connective Payments’ project managers, besides their experience in project management (incl. agile/scrum approach), also have a lot of substantive knowledge in the field of technology (POS, ATM), schemes, regulations and roles of the various players in the chain (banks, PSPs, processors, etc.). This combination enables them to quickly and successfully pick up payments projects for various domains (on-line, giro and cash).

Operational aspects of the Paystation:

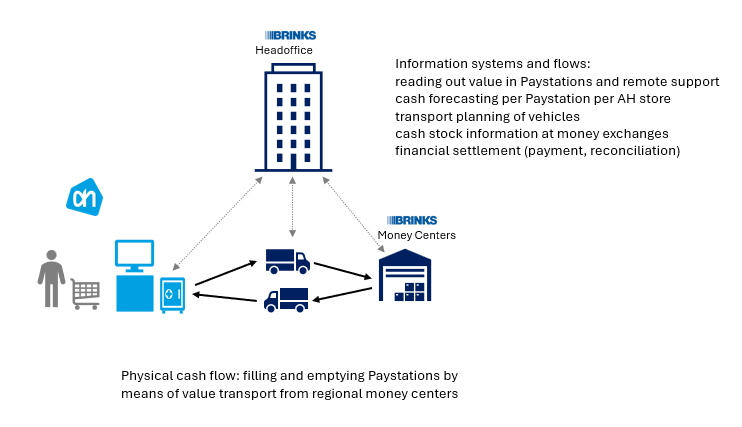

- Have additional service agreements been made regarding the emptying and/or maintenance of the Paystations, or do the existing agreements between the retailer and Brinks apply to this?Additional service agreements are in place whereby Brinks facilitates the complete carefree operation: from filling the Paystation itself to transporting and emptying the machine. Based on historical data per Paystation, required amount of cash is “predicted” and transports are planned.

- How fault-prone are Paystations and can shop staff fix simple faults, jamming etc. themselves?

The simple breakdowns can be done by employees themselves. During the pilot period, breakdowns were tested through and through; this resulted in an uptime of almost 100%. Faults can also be fixed on weekends, evenings and public holidays. - Can the manned tills be refilled with coins and notes from the Paystations?

It is often chosen not to allow the transfer of cash on the shop floor from one till to another. Besides, the systems actually ensure that employees can work safely and checkout discrepancies are a thing of the past. - Can customers also withdraw cash, in other words, the Paystation also works as an ATM?

This function may become available in the near future. In this way, consumer demand to keep cash available can also be met in the future.

Many thanks to Martijn Wiersma and Frints Steenmeijer for their valuable contribution to this article.