“Adding execution power to your organisation’s transformation agenda”

Illustrative use case

Consider a scenario where a company sets its sights on entering new geographical markets. While the aspiration is clear, the execution falters due to misaligned functions in the organisation. Sales capabilities are lacking, operational teams struggle with new toolsets, HR faces challenges in sourcing the right school sets, voice of the customer is not heard in product user experience. Enter the Target Operating Model (TOM) comes in to help fix these problems and pave the way towards successful transformation.

Why the emphasis on TOM?

Businesses need to keep up with changes like new ways of selling products, or regulatory and compliance demands and technological advancements. To stay ahead, the TOM provides a structured framework to bridge the gap between strategic vision and operational reality. TOM is like a guide that helps companies adapt to these changes. It’s like a map that shows where the company wants to go and how to get there.

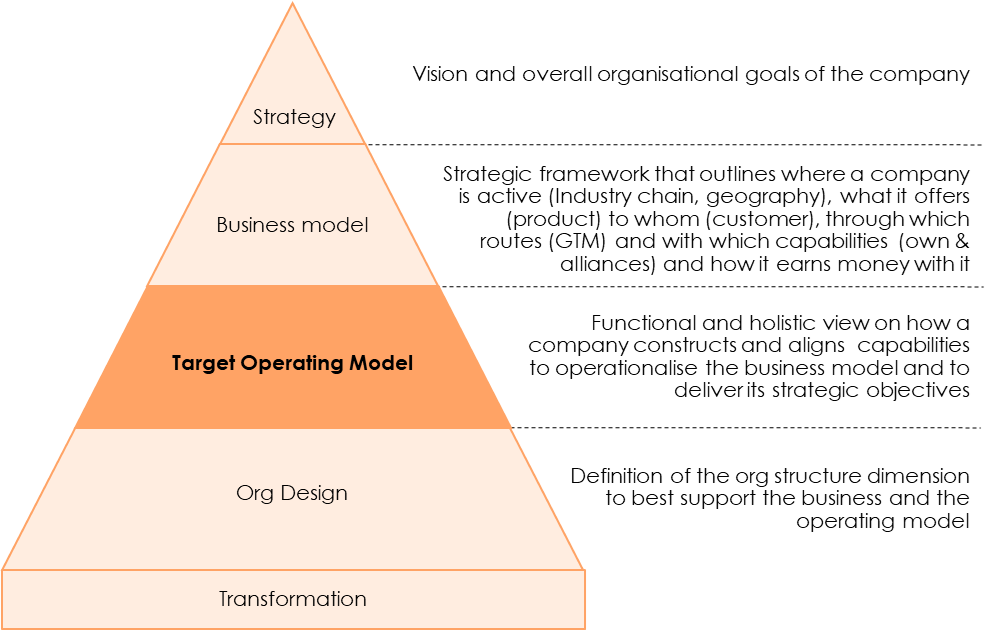

Understanding the TOM

At its core, a TOM serves as a diagnostic instrument within the context of Organisational Transformation to identify the issues and pain points in the organisation to realise and meet the new strategic direction. Comprising guiding principles, capability models, metrics, roles, processes, and technology frameworks, it embodies a holistic approach to organizational realignment.

Who does TOM help?

The TOM is particularly useful for actors in the retail payment value chain that undergo significant change and that need execution power to help the organisation to adapt. It can be a great communication tool for senior management as it outlines the way forward with clarity and precision.

What are the high-level advantages of a TOM?

TOM pinpoints problems across different departments and makes sure they match up with the big goals. Plus, it involves everyone in the company, not just the leadership. It helps to take a full-scale look at the organization to figure out what changes are needed for each part to reach long-term goals, and what steps to take in the short and medium term. In short, TOM is a roadmap to ensure your company is ready to transform.

Connective Payments is here to help you

- Develop the To Be Operating Model that provides the necessary components to achieve the Strategic objectives/ business plan (Target Operating Model)

- Define the capabilities in support of the Operating Model (capability framework)

- Assess the gaps in capability and maturity (gap analysis)

- Close the gaps by identifying initiatives and activities required (transformation plan and implementation